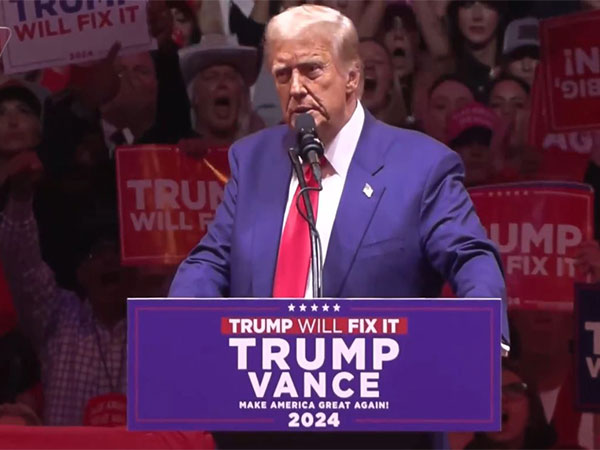

Global Markets Rise Amid Trump Presidency Speculation and Economic Jitters

Asia-Pacific equity markets rose on Thursday after a surge in U.S. shares, driven by Trump presidency implications and central bank policies. Market dynamics included U.S. Treasury yield climbs and currency fluctuations, with global investors looking towards the U.S. for growth prospects amidst political uncertainties in Europe.

Asia-Pacific equity markets saw an upswing on Thursday, bolstered by a record rise in U.S. shares the previous night. Investors assessed potential impacts of a Donald Trump presidency while also keeping a close watch on policy decisions from the U.S. Federal Reserve and other central banks.

U.S. stock futures suggested further gains after all major Wall Street indexes soared, anticipating a Republican sweep that could lead to significant fiscal spending. Meanwhile, U.S. Treasury yields surged, reflecting risks of larger deficits, prompting a notable rise in the dollar.

In Europe, political developments influenced market sentiment. Chancellor Olaf Scholz's dismissal of Finance Minister Christian Lindner led to the collapse of Germany's ruling coalition, setting the stage for early elections. This political shake-up added pressure on the euro while boosting German and broader European market movements.

(With inputs from agencies.)

ALSO READ

Wall Street Holds Steady as Treasury Yields Weigh on Tech Giants

Wall Street Boosts Global Equity as Treasury Yields Rise

Santa Claus Rally Faces Hurdles Amid Rising Treasury Yields

Treasury Yields and Their Impact on Year-End Equity Rally

Emerging Markets React Cautiously to Economic Data and Political Uncertainties