Yen Hits Three-Month Low Amidst Political Shift in Japan

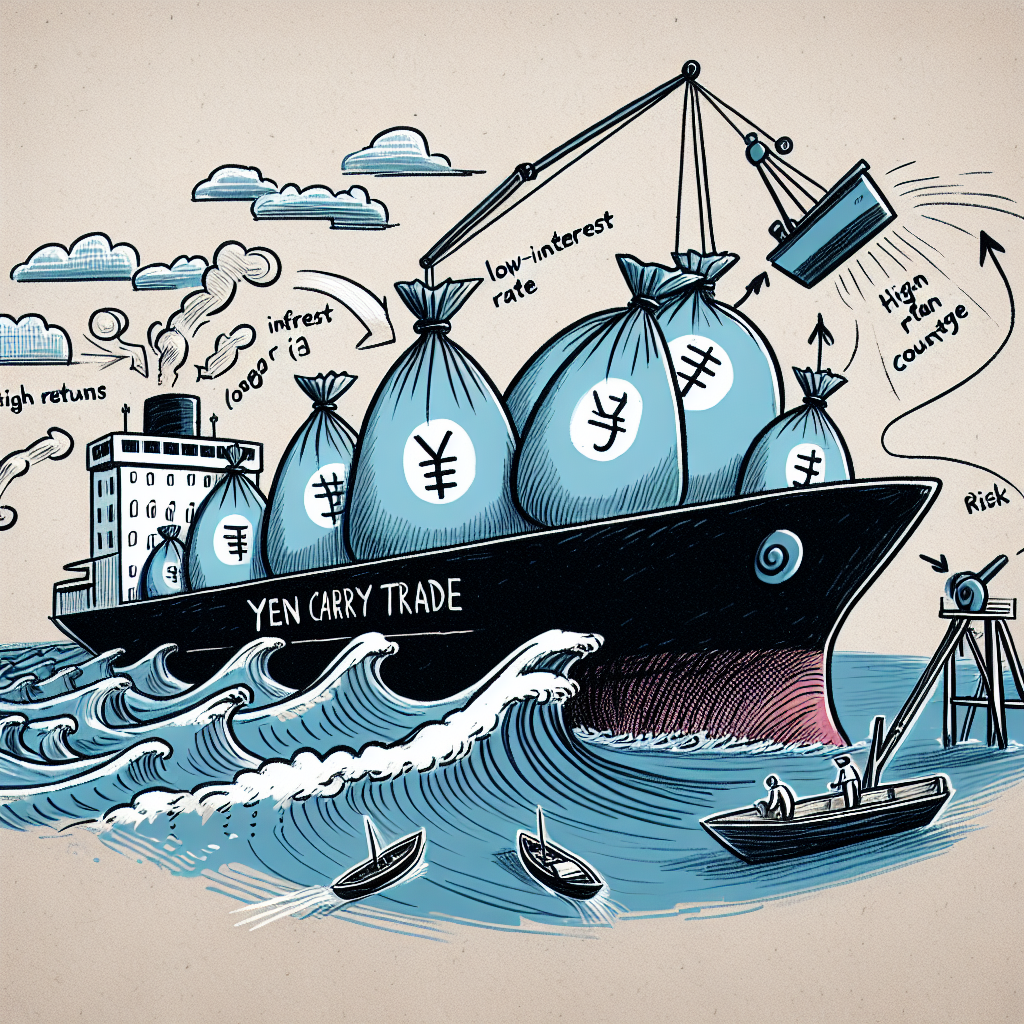

The yen reached a three-month low due to Japan’s election outcomes, potentially slowing rate hikes. Meanwhile, the dollar strengthened with prospects of Donald Trump's presidency, causing a significant rise in US yields. Currency markets remain tense with economic data releases expected this week.

The yen fell to a three-month low as Japan's ruling coalition suffers a parliamentary setback, raising concerns about delayed interest rate hikes. The coalition's 209-seat win is a drop from its previous 279 seats, reflecting the poorest outcome since 2009.

This electoral fall suggested a potentially dovish economic approach, putting pressure on Japan's central bank. Meanwhile, the dollar is riding high due to growing U.S. yields and election speculation, achieving its biggest monthly rise in over two years.

Currency markets remain volatile amid economic reports, including crucial inflation data from Europe and Australia and GDP data from the U.S. The situation remains fluid pending Japan's upcoming interest rate decision.

(With inputs from agencies.)

ALSO READ

Northeast Natural Gas Grid Poised to Boost India's Energy Economy by 2026

BJP's Bold Vision for Maharashtra: Empowering All to Boost Economy

India's Charge Towards a Gas-Based Economy: A Greener, Self-Reliant Future

Shigeru Ishiba Reelected Amid Political Turmoil: Navigating Japan's Fraught Political Landscape

Andhra Pradesh Unveils Ambitious 2024-25 Budget to Revitalize State Economy