Yen's Rebound: BOJ Remarks Spark Currency Strength

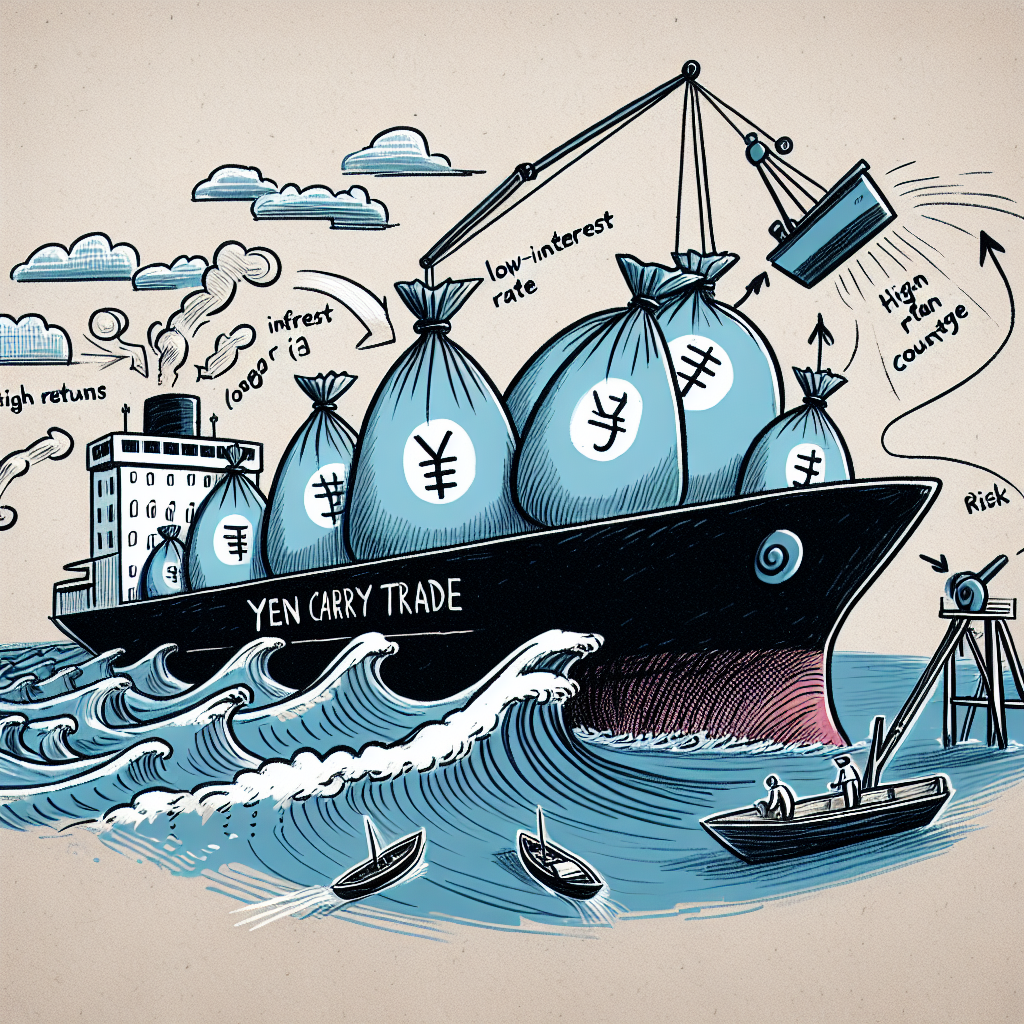

The Japanese yen strengthened after the Bank of Japan presented a less dovish outlook, accompanied by a dip in the U.S. dollar. Japan’s adjustment in monetary policy stance and upcoming U.S. economic events influenced currency movements, highlighting geopolitical and fiscal uncertainties impacting market trends and central bank decisions.

The yen showed newfound strength on Thursday following less dovish remarks from the Bank of Japan. Meanwhile, the U.S. dollar slipped just ahead of key jobs data and the impending U.S. presidential election. The dollar fell 0.6% against the yen, valued at 152.360.

BOJ Governor Kazuo Ueda's comments deviated from previous positions, suggesting a shift towards scrutinizing U.S. economic risks more closely. This stance sent a signal that the Bank of Japan may consider raising interest rates, bolstering the yen.

Elsewhere, the pound gained on stronger British budget moves, the euro ticked higher on positive economic indicators, and market participants closely monitored potential shifts due to the U.S. election and employment data.

(With inputs from agencies.)

- READ MORE ON:

- yen

- BOJ

- Japan

- dollar

- currency

- interest rates

- election

- monetary policy

- economic data

- inflation

ALSO READ

Election Crackdown in Thane: Millions Seized in Cash Raids

Political Showdown in Maharashtra: BJP and MVA Lock Horns Ahead of Elections

Showdown in Bengal: By-Elections Amidst Healthcare Uproar

Homebound Heroes Make Their Mark in Thane Elections

Modi's Magic Set to Influence Upcoming Jharkhand and Maharashtra Elections