RBI Deputy Governor Calls for Enhanced Data Approach Under Insolvency Code

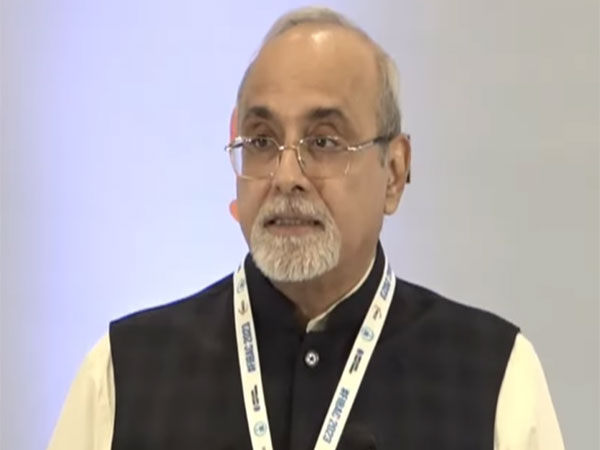

Deputy Governor M Rajeshwar Rao urges for structured data under the Insolvency and Bankruptcy Code to better handle complex cases. Speaking at an international event, he stresses the need for improved resolution ecosystems and valuation insights to enhance the insolvency process and address delays caused by uncooperative debtors.

- Country:

- India

In a focused address, M Rajeshwar Rao, Deputy Governor of the Reserve Bank of India, underscored the necessity of institutionalising data within the Insolvency and Bankruptcy Code (IBC) to guide the handling of intricate cases.

Speaking at the International Conclave organised by the IBBI and INSOL India in New Delhi, Rao emphasized that structured data collection is crucial for disseminating insights to stakeholders. Despite notable strides in bank balance sheet improvements, he identified areas needing further enhancement, particularly in understanding default causes. Rao pointed to the need for refining the resolution ecosystem, highlighting issues such as economic conditions, industry-specific problems, and mismanagement as critical factors.

Rao addressed the hurdles posed by some corporate debtors, including delays in information sharing and stalling tactics. He advocated for better valuation practices and mechanisms to align out-of-court resolution efforts with statutory IBC processes. His call for measures to effectively enforce the code and unlock economic value reflects the RBI's commitment to a robust insolvency framework.

(With inputs from agencies.)

ALSO READ

Assam to conduct evaluation of schools through ‘Gunotsav’ in Jan-Feb 2025

Forex reserve is strong and a large part of recent depletion due to valuation losses, says RBI Governor Das.

NHC Foods Unveils Rs.47.42 Crore Rights Issue at Attractive Valuation

International Gemmological Institute IPO Sparkles at Rs 4,225 Crore Valuation

Do IMF Programs Shape Gender Equality? Evidence from Rigorous Global Evaluation