RBI Ensures Soft Landing Amid Continued Inflation Challenges

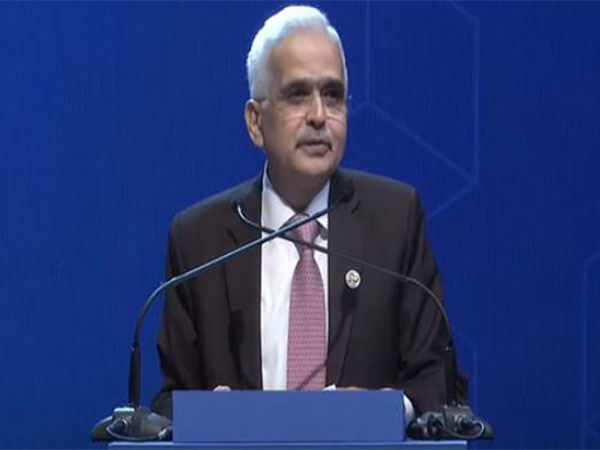

RBI Governor Shaktikanta Das highlighted the central bank's effort to maintain economic stability amidst potential inflationary risks and growth slowdown. Despite global challenges, India's external sector remains robust. The RBI continues its commitment to control inflation and plans to release guidelines on climate-related financial risks soon.

- Country:

- India

Speaking at the CNBCTV18 Global Leadership Summit, Reserve Bank Governor Shaktikanta Das addressed the central bank's handling of economic challenges. He warned of ongoing risks of inflation resurgence and growth deceleration, asserting the RBI's commitment to a 'soft landing' despite numerous headwinds.

Das highlighted measures taken by central banks worldwide to combat soaring inflation due to supply chain disruptions and geopolitical tensions, such as the Ukraine conflict. While the RBI maintained the repo rate at 6.5% for the 10th time, Das emphasized the persistent threat of inflation, especially due to food prices.

On a positive note, Das commended India's external sector for its resilience, with the current account deficit remaining stable and merchandise exports recovering. He noted that robust services exports and remittances are bolstering the economy. Furthermore, India's significant foreign exchange reserves provide a buffer against external shocks.

(With inputs from agencies.)

ALSO READ

FICCI's Optimistic Outlook for India's Economic Growth Amid Global Challenges

Chhattisgarh's Bold Strides: Eradicating Naxalism and Boosting Economic Growth

Navigating Economic Growth Amid Trade War Threats

SA and Angola Forge Stronger Trade Ties to Boost Intra-Africa Economic Growth

China Targets 5% Economic Growth Amid Global Uncertainty