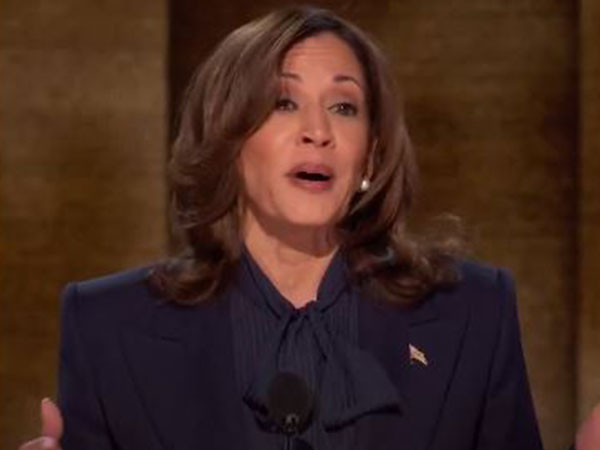

Kamala Harris Proposes Tax Reforms for Small Businesses in New Hampshire Speech

Vice President and Democratic presidential candidate Kamala Harris proposed a 28% capital gains tax rate for high earners and a $50,000 tax deduction for new small businesses in a speech in North Hampton, New Hampshire. She aims to support small businesses and maintain middle-class growth, while countering Republican policies.

Vice President Kamala Harris, the Democratic presidential candidate, unveiled key fiscal proposals during a campaign stop in North Hampton, New Hampshire, on Wednesday. Harris recommends setting the capital gains tax rate at 28% for individuals earning over $1 million, diverging from President Biden's proposed 39.6% rate for the same group in his fiscal 2025 budget.

In her speech at the woman-owned Throwback Brewery, Harris also suggested offering a $50,000 tax deduction for new small businesses, up from the current $5,000 tax break. This initiative aims to lower the average $40,000 startup cost, aligning with Harris's broader goal of seeing 25 million new small business applications by the end of her first term.

Harris's policy stance highlights her support for small businesses, proposing low- and no-interest loans and expanded venture capital access. She emphasized the necessity of a minimum tax for billionaires to address income disparities while criticizing former President Donald Trump's policies for potentially harming small business growth. Recent polls show Harris with a slight edge over Trump in New Hampshire ahead of the November 5 election.

(With inputs from agencies.)

ALSO READ

Nigeria's Parliament Approves Major Tax Reforms Amid Mixed Reactions

Trump Administration Dismisses Biden's Immigration Law Challenges in Iowa and Oklahoma

Ceasefire Talks: Zelenskiy and Biden Navigate Complex Diplomatic Waters

Trump says he is ending Secret Service protection for Biden's adult children, which had been extended until July, reports AP.

Trump Ends Secret Service Protection for Biden's Children