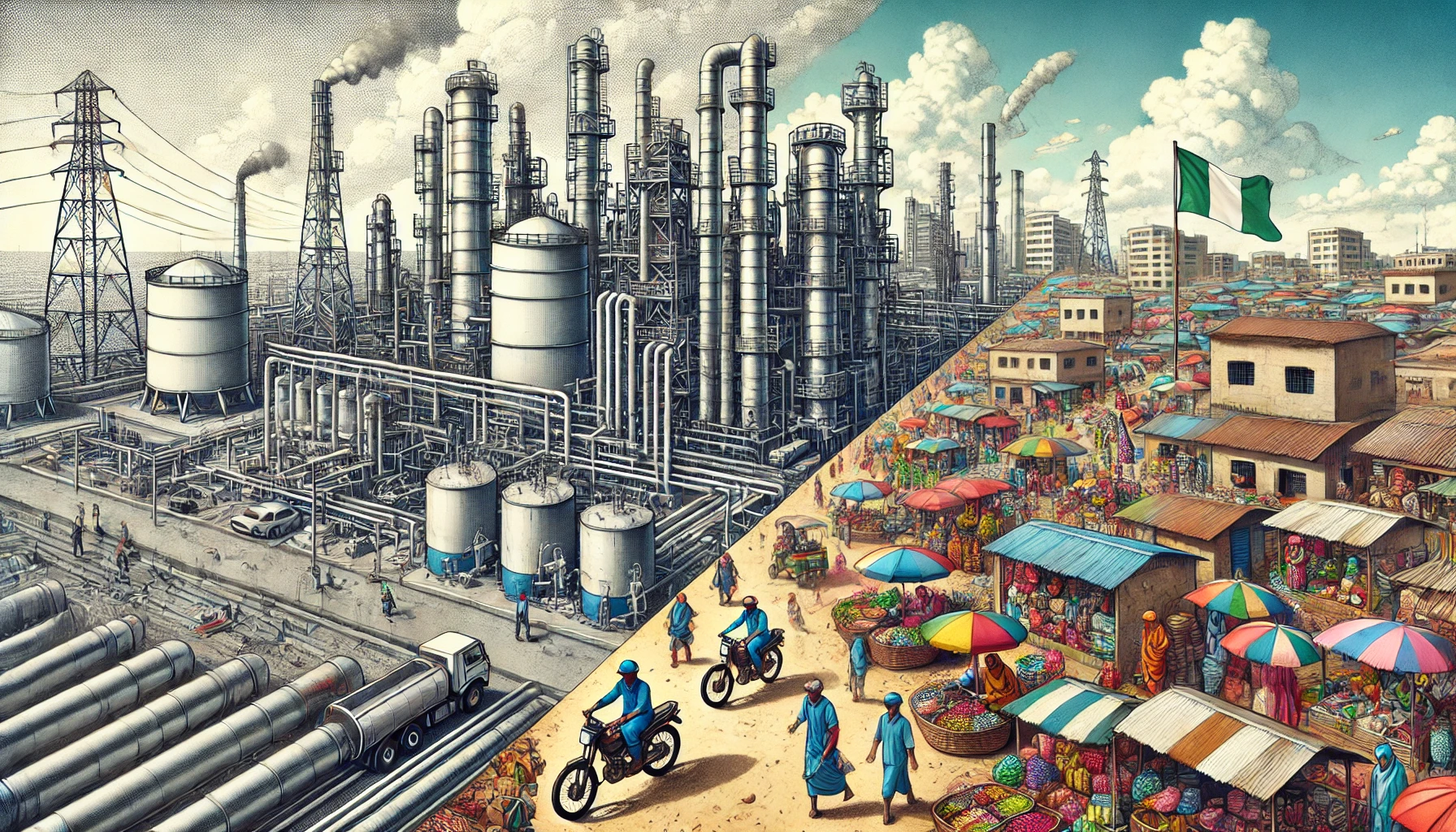

Fuel Subsidy Removal: Economic Impacts and Policy Solutions for Oil-Rich Nations

The study by the African Development Bank and collaborators analyzes Nigeria's fuel subsidy removal, revealing its disproportionate impact on low-income households and amplified economic vulnerabilities during oil price volatility. It underscores the need for adaptive monetary policies and targeted social safety nets to ensure equitable and stable reforms.

Researchers from the African Development Bank, Norges Bank, and Swansea University have undertaken an in-depth analysis of the economic and social impacts of fuel subsidy removal in Nigeria, one of Africa’s largest oil producers. Using a Markov-switching dynamic stochastic general equilibrium (DSGE) model, the study explores how volatile oil prices and evolving monetary policies influence the outcomes of subsidy reforms. Drawing on data from 2000 to 2021, the research examines welfare implications, inflationary pressures, and macroeconomic stability challenges, offering critical insights for policymakers. The focus is on how central banks can adapt monetary frameworks to balance the short- and long-term consequences of subsidy removal. Historically, subsidies in Nigeria have provided stability to domestic energy prices, helped mitigate energy poverty, and reduced inequality. However, their inefficiencies, fiscal burden, and contribution to widening income disparities have fueled debates over their utility. The removal of subsidies in May 2023 brought these discussions to the forefront, prompting an analysis of their far-reaching consequences.

Uneven Impacts on Household Welfare

The study reveals that subsidy reforms have disproportionately adverse effects on low-income households while providing relative benefits to wealthier groups. Richer households, often the primary beneficiaries of fuel subsidies, experience a boost in consumption and welfare following subsidy removal, leading to a widening wealth gap. In contrast, vulnerable populations, reliant on subsidies to access energy, face increased costs of living and diminished economic resilience. This exacerbates existing inequalities and poses socio-economic risks, particularly in regions already struggling with poverty and unemployment. The findings underscore the importance of targeted social safety nets to cushion these impacts and ensure that the benefits of subsidy removal are equitably distributed. Without such measures, the transition risks becoming a source of economic and social instability, especially during periods of high oil price volatility.

The Role of Oil Price Volatility

Oil price volatility significantly influences the outcomes of subsidy removal, the research finds. During periods of high volatility, such as the global financial crisis in 2008, the oil price collapse of 2014-2016, and the pandemic-induced shocks of 2020-2021, the Nigerian economy experienced heightened macroeconomic instability. The removal of subsidies under such conditions amplifies economic vulnerabilities, leading to sharper contractions in output, higher inflation, and increased welfare costs. The DSGE model highlights that subsidy reforms exacerbate these challenges by reducing the ability of governments and households to respond to external shocks. This necessitates adaptive monetary policies tailored to the prevailing economic environment. By focusing on inflation targeting and proactive interest rate adjustments, central banks can help mitigate the adverse effects of subsidy removal, albeit with trade-offs in output stability.

Monetary Policy in a Subsidy-Free Economy

The study emphasizes the critical role of monetary policy in managing the transition to a subsidy-free economy. In the absence of subsidies, the central bank must adopt a more aggressive approach to inflation targeting and interest rate management. During high-volatility periods, optimal monetary policy involves proactive measures to stabilize inflation and support aggregate demand. The research also identifies significant gaps in Nigeria’s historical monetary responses to oil price shocks, which often failed to achieve optimal outcomes. To address these issues, the researchers advocate for regime-specific monetary policy frameworks that can switch dynamically between different economic states. Such an approach enables policymakers to navigate the complexities of oil price fluctuations and subsidy removal while balancing inflation and output stabilization.

Policy Recommendations for Effective Reforms

The findings offer critical policy recommendations for Nigeria and other oil-producing economies. First, coordinated fiscal and monetary strategies are essential to ensure a smooth transition away from subsidies. Fiscal measures, such as direct cash transfers and subsidies for alternative energy sources, can complement monetary policies and protect vulnerable populations. Second, institutional reforms to improve transparency and governance in subsidy administration are crucial. Strengthened institutions can enhance public trust and reduce resistance to reform. Third, a phased and gradual approach to subsidy removal, coupled with robust stakeholder engagement, can mitigate socio-political risks and enhance policy acceptance. Additionally, the study highlights the potential for subsidy removal to create fiscal space for investments in infrastructure, education, and healthcare, which can drive long-term economic growth and development.

Striking a Balance Between Stability and Equity

The research underscores the delicate balance between macroeconomic stability and social equity in subsidy reforms. While removing subsidies can free up fiscal resources and address inefficiencies, it also poses significant risks to vulnerable populations and the broader economy. Policymakers must adopt a holistic approach that integrates adaptive monetary policies, targeted social measures, and long-term developmental strategies. By focusing on inclusive growth and equitable distribution of reform benefits, Nigeria and other oil-producing nations can navigate the challenges of subsidy removal while safeguarding the welfare of their populations. The study’s comprehensive analysis provides a roadmap for designing effective and sustainable reforms, emphasizing the importance of resilience, flexibility, and equity in policy frameworks.

The study sheds light on the economic and social dimensions of fuel subsidy removal, offering valuable lessons for policymakers in Nigeria and beyond. By examining the interplay between oil price volatility, monetary policy, and household welfare, it highlights the complexities of subsidy reforms and the need for nuanced, data-driven approaches. As oil-producing economies face increasing pressure to reform subsidy regimes, this research provides a timely and actionable framework for managing the transition. By addressing immediate challenges and leveraging the long-term benefits of reform, Nigeria has the potential to transform its subsidy policy into a catalyst for sustainable growth and social progress.

- FIRST PUBLISHED IN:

- Devdiscourse