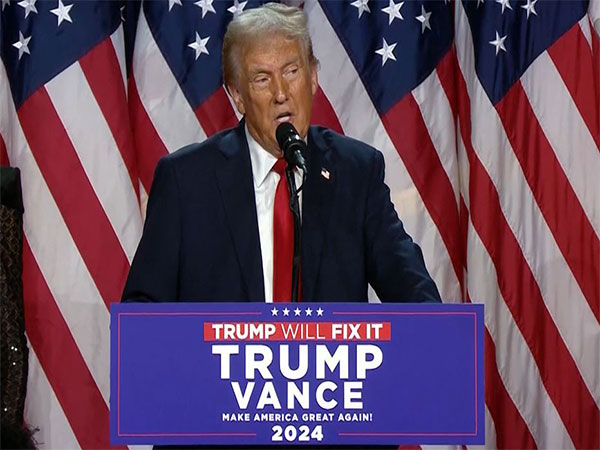

Market Turmoil as Trump Leads in US Election

Global commodities fell sharply as a Trump lead in the U.S. election spooked markets. Oil, metals, and grains suffered losses due to a stronger dollar. Analysts predict potential tariffs on Chinese goods if Trump wins, impacting metal prices and the global economy.

Commodities markets witnessed significant declines on Wednesday, driven by a rising U.S. dollar and investor anticipation of Donald Trump's victory in the presidential race. Oil, metals, and grains experienced notable drops, as reported by multiple sources.

With Trump reportedly securing 270 electoral votes, according to Fox News, market dynamics were influenced by expectations of renewed tariffs on Chinese goods. This scenario is detrimental to metals, especially given China's role as a primary consumer.

Industrial sectors, particularly China's steel industry, could face downturns under Trump's policies, which include substantial tariffs on imports. Energy markets also brace for potential geopolitical tensions, affecting oil supplies with Iran and agricultural retaliation from China.

(With inputs from agencies.)

- READ MORE ON:

- commodities

- Trump

- victory

- tarrifs

- dollar

- U.S. election

- metals

- oil

- supply

- demand

ALSO READ

Dollar Surge and Bitcoin Buzz: Financial Markets Rumble Post-Trump Victory

U.S. Dollar's Dominance: Trump’s Trade Policies and Treasury Yields Ignite Growth

Trump's Impact on Markets: Crypto Surge and Dollar Rise Amid Policy Shifts

Market Movements Stir Amid Inflation and Dollar's Surge

Dollar Dominance: U.S. Currency Surges to New Highs