Trade Tensions Slam Nvidia; Gold Soars Amid Economic Jitters

Asian markets faced declines as U.S. restrictions on Nvidia's chip sales to China stirred global trade tensions. Despite China's economic growth surpassing expectations, conflicts with the U.S. loom over its future. Gold reached record highs amid ongoing tariff disputes and economic uncertainties.

Shares in Asia experienced declines on Wednesday, notably impacted by American tech firm Nvidia suffering from U.S. restrictions on chip sales to China. This development highlights the ongoing tensions in the escalating global trade war. Meanwhile, gold prices soared to record levels, and the U.S. dollar came under pressure.

China's economy grew by 5.4% in the first quarter, surpassing forecasts despite the pall of U.S.-China trade tensions. In response to rising economic uncertainties, President Donald Trump announced a probe into potential new tariffs, specifically targeting U.S. imports of critical minerals, pharmaceuticals, and chips. Simultaneously, China reportedly directed airlines to halt deliveries of Boeing aircraft.

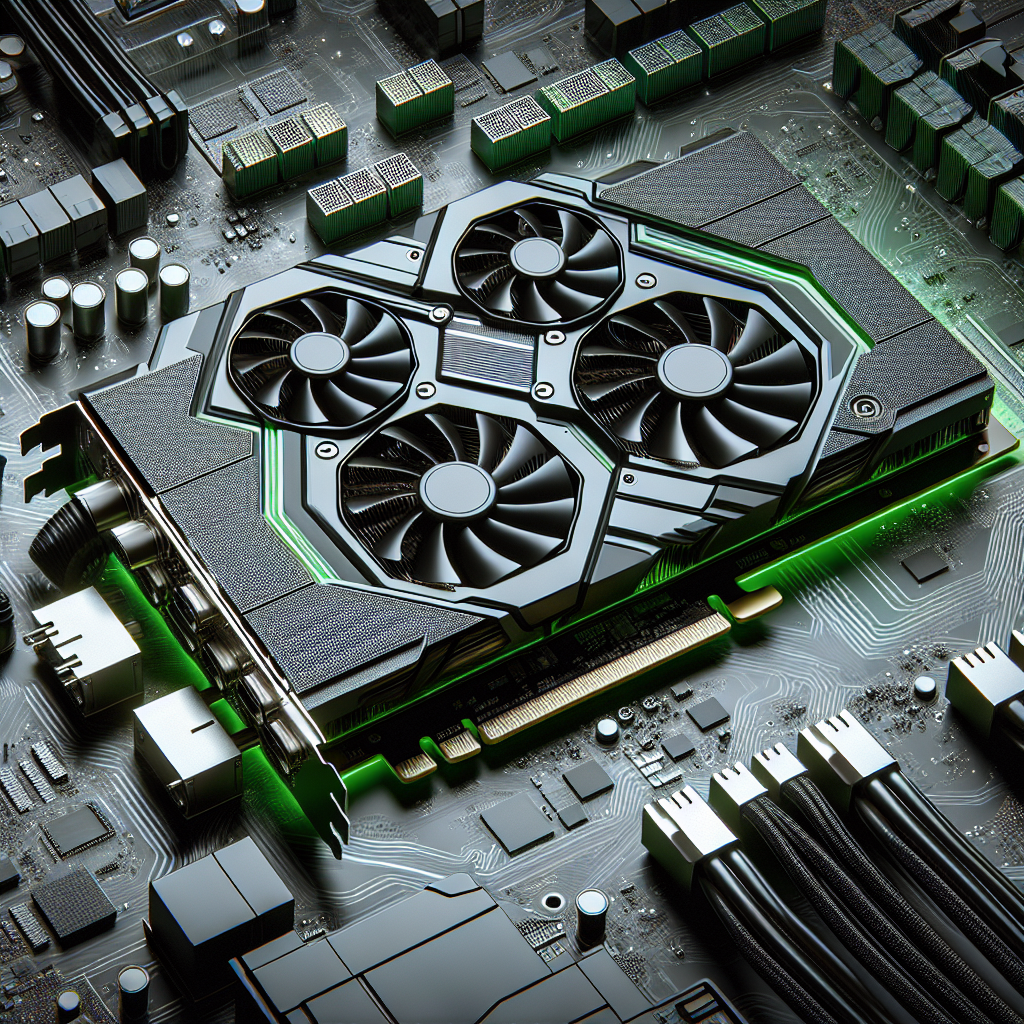

Nvidia's share prices fell drastically, losing 6% of their market value in the aftermath of the U.S. government's decision to restrict its H20 AI chip exports to China. This regulatory move has been viewed as an indicator of significant future challenges in U.S.-China tech relations, causing market concern. Additionally, both countries seem poised to hold firm on their respective stances, potentially dragging out the trade stalemate.

(With inputs from agencies.)

ALSO READ

UN Under Siege: Rising Tensions and Deadly Attacks

Tensions Flare Amid Stalled Gaza Ceasefire

Justice Department Unveils Jeffrey Epstein Files Amidst Public Curiosity and Political Tensions

U.S. Millennium Challenge Corporation Forges New Economic Partnerships in Latin America

Deadly Missile Strike on Odesa Port Sparks Escalating Tensions