Yen Surges as Global Rates Navigate Economic Crossroads

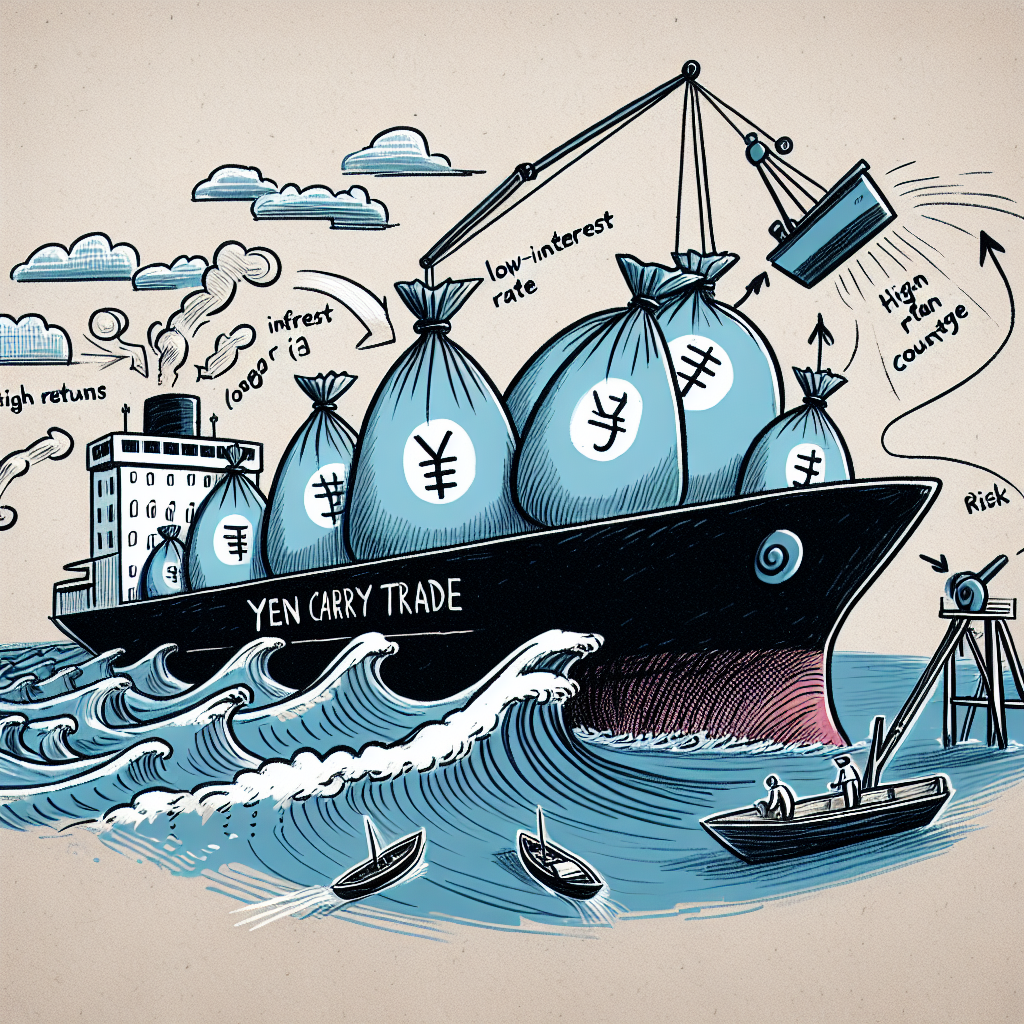

The yen strengthens as Japan prepares to raise interest rates, diverging from other global economies cutting rates. The European Central Bank is expected to reduce rates to support the struggling EU economy. The U.S. Federal Reserve's current stance suggests further ease is possible, while Brazil opts for hikes.

The yen showed remarkable strength on Thursday, as Japan appears set to continue raising interest rates, contrasting with other global economies that are cutting rates. The European Central Bank (ECB) is expected to announce another rate cut today amidst economic challenges in the euro area.

The euro remains stable against the dollar, trading at $1.0423. Analysts from ANZ emphasize the declining inflation in the euro area, urging the ECB to take further steps to support growth. Meanwhile, the Bank of Japan continues to hint at more rate hikes in its economic strategy.

Global financial dynamics are in play as the U.S. Federal Reserve pauses its easing cycle, although futures markets still anticipate more cuts this year. Amid these shifts, Brazil raises rates, drawing investors with its high returns and causing a 5% rally in the real since January.

(With inputs from agencies.)

- READ MORE ON:

- Yen

- interest rates

- Japan

- ECB

- euro

- Federal Reserve

- economy

- inflation

- markets

- growth

ALSO READ

World Bank Approves $32.23 Million Belize Blue Economy Project to Safeguard Marine Resources

European Markets Tumble Amid Fears of Trade Tensions

Europe's Crisis: Polluted Waters and Political Challenges

European Markets Tumble Amid Trade Tensions and Sector Losses

Tariff Tensions Shake Euro Zone Bond Market