RBI announces linking of pre-sanctioned credit lines with UPI to enhance faster credits

The RBI proposed extending the scope of pre-sanctioned credit lines via the Unified Payments Interface (UPI) to Small Finance Banks (SFBs).

- Country:

- India

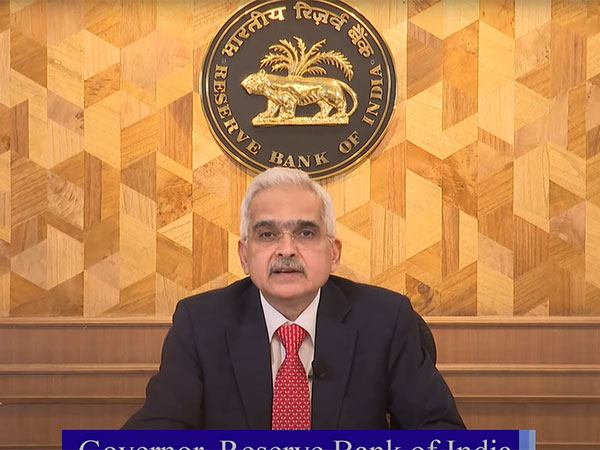

In its latest monetary policy announcement on Friday, the Reserve Bank of India (RBI) Governor Shaktikanta Das unveiled significant measures to enhance the financial ecosystem, focusing on payment systems and the responsible integration of frontier technologies like Artificial Intelligence (AI). The RBI proposed extending the scope of pre-sanctioned credit lines via the Unified Payments Interface (UPI) to Small Finance Banks (SFBs).

Initially introduced in September 2023, this feature allowed Scheduled Commercial Banks, except Payment Banks and SFBs, to link pre-sanctioned credit lines to UPI, enabling seamless funding for low-ticket, short-tenor credit products. SFBs, with their high-tech and cost-efficient operational models, are well-positioned to serve last-mile customers, particularly "new-to-credit" individuals.

By integrating credit lines into UPI, the move aims to enhance financial inclusion and credit accessibility. Necessary operational guidelines for SFBs will be issued shortly, marking a milestone in the UPI ecosystem's evolution. To address the dual challenge of leveraging AI's transformative potential while mitigating associated risks, the RBI announced the establishment of a committee to develop a Framework for Responsible and Ethical Enablement of Artificial Intelligence (FREE-AI) in the financial sector.

AI technologies, including Machine Learning (ML), tokenization, and cloud computing, offer efficiency and enhanced decision-making capabilities but also bring risks like algorithmic bias and data privacy concerns. The proposed committee, comprising experts from diverse fields, will design a robust and adaptable framework to ensure the ethical and safe deployment of AI in financial operations. Details of the committee's composition and mandate will be released soon.

RBI is taking proactive steps to tackle the growing menace of digital fraud, particularly involving mule bank accounts used for money laundering. A promising pilot initiative, MuleHunter.AITM, developed by the Reserve Bank Innovation Hub (RBIH), employs AI/ML models to detect mule accounts efficiently.

Piloted with two major public sector banks, the model has shown encouraging results. The initiative aligns with the RBI's ongoing hackathon, "Zero Financial Frauds," aimed at innovating solutions to combat digital fraud. Banks are being urged to collaborate with RBIH to refine and scale the MuleHunter.AITM project, underscoring the RBI's commitment to cybersecurity and fraud prevention. (ANI)

(This story has not been edited by Devdiscourse staff and is auto-generated from a syndicated feed.)

- READ MORE ON:

- UPI

- SFBs

- AI

- Financial inclusion

- Credit

- Ethical AI

- Mule accounts

- Digital fraud

- Cybersecurity

- Payments