Banks Face Challenges as Deposit Growth Slows: SBI Report

SBI Securities reports challenges for banks due to slowed deposit growth, increased reliance on market borrowings, and intensified competition affecting Net Interest Margins. Credit growth to agriculture declines, while industrial credit sees modest growth. UPI transactions continue to grow, although at a slowing pace.

- Country:

- India

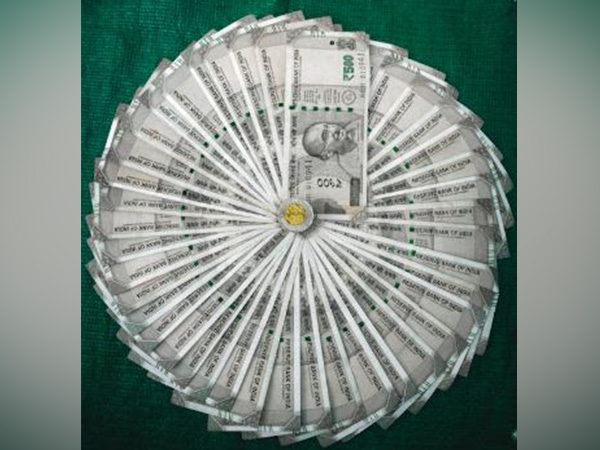

A recent report by SBI Securities indicates that banks in the country are grappling with the challenges posed by a slowdown in deposit growth. This decline has compelled them to increasingly depend on external market borrowings to meet their capital needs. The report underscores that this growing dependency, coupled with fierce competition to attract deposits, is exerting considerable pressure on their Net Interest Margins (NIMs).

'Slowdown in deposit growth has led to banks increasingly relying on external market borrowings for their capital requirements. This coupled with the fight for deposits has created pressure on banks' Net Interest Margins (NIMs)' stated the report. NIM reflects the disparity between the interest earnings of banks and the interest disbursed to depositors, serving as a crucial indicator of a bank's profitability. The current situation suggests that banks might face difficulties in maintaining their margins amid rising costs of funds.

The report also shed light on sectoral credit deployment for June 2024. Specifically, credit growth to agriculture and related activities has decreased, dropping to 17.4 per cent in June 2024 from 19.7 per cent in June 2023. This indicates a prudent approach by banks in lending to this sector, possibly due to repayment concerns or reduced credit demand. Conversely, industrial credit experienced modest growth, recording an 8.1 per cent year-on-year (YoY) increase.

'Sectoral deployment data for June'24 shows credit growth to agriculture and allied activities declined to 17.4 per cent in Jun'24 from 19.7 percent in Jun'23. Industrial credit grew 8.1 per cent YoY' the report added. In the digital payments sector, the Unified Payment Interface (UPI) continues to exhibit robust performance. In July 2024, UPI transactions soared to 14.4 billion, marking a substantial 45 per cent YoY growth.

The total value of these transactions remained strong, surpassing Rs 20.0 trillion, with a 35 per cent YoY increase. However, the report highlighted that the YoY growth in both transaction value and volume has been decelerating since March 2024, attributed to the base normalization following UPI's widespread adoption.

(With inputs from agencies.)

ALSO READ

Rainwater Harvesting Transforms Agriculture in West Bengal's Saline Lands

Strengthening Ties: Bhutan-India Collaboration in Agriculture and Education

Rising GST, Resilient Agriculture Buoys India's Economy Amid Decelerating Bank Credit

Government Moves to Cut Red Tape for Agriculture and Horticulture Products

Revolutionizing Nagaland's Agriculture: Reefer Trucks Empower Farmers